Pharmaceuticals

CPhI Worldwide 2021 Annual Report: Looking ahead to CMO/CDMO M&As 3rd November 2021

By Editorial Team for CPhI Worldwide Special - By Adam Bradbury, Analyst, GlobalData PharmSource

Increasing private equity investment and the race for biologics and specialized capabilities drive the CMO industry’s M&A activity. This exclusive article has been adapted from the 2021 CPhI Worldwide Annual Report, which is released at the event (Fiera Milano, Italy, November 9-11, 2021) and includes a comprehensive analysis from leading industry experts on the key trends and future innovations in pharma.

Private equity (PE) firms have recently shown an increasing appetite for contract manufacturing organizations (CMOs) with rapidly increasing investments in the CMO industry. PE firms now own many of the world’s leading CMOs, such as Recipharm, Cambrex Corporation, and PCI Pharma Services. Besides the large volume of acquisitions, values in recent PE-related deals are also remarkably high. In December 2020, EQT IX Fund, through Roar BidCo AB, agreed to acquire Recipharm AB, one of the largest dose CMOs, for approximately $2.1 billion. Lars Back sell, Chairman of the Board of Recipharm, and Thomas Eldered, Board Member and Chief Executive Officer of Recipharm, are shareholders of Recipharm and participated with EQT IX in the offer.

The Tax Cuts and Jobs Act of 2017 in the US, passed under President Trump, reduced corporate tax rates and increased the spending power of PE companies, leading to rising level of investment in the CMO industry. According to GlobalData’s M&A in the Contract Manufacturing Industry: Implications and Outlook – 2021 Edition report, the most common type of acquirer was PE firms, which increasingly view the CMO industry as a prudent choice to provide a good return on investment. This group rose to the top among acquirers during 2018-2020, compared to four years earlier when they were in third place. More PE firms were buying than selling, indicating a strong investor appetite.

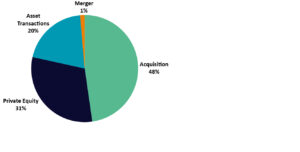

PE firms acquired almost 70 pharmaceutical contract manufacturing companies, and PE-backed CMOs acquired eight companies during 2018-2020. PE firms most commonly bought active pharmaceutical ingredient (API), biologics and multi-service offering CMOs. These service types are of high value and are most likely to be sold later on for a profit. Supply chain disruption and problems with mass vaccine production mean there are currently significant opportunities for CMOs, and they represent a particularly prudent investment opportunity for PE firms. Figure 1 shows the extent of acquisition activity in the CMO sector compared to other deals such as private equity investments, asset transactions and mergers.

Figure 1: CMO merger and acquisition (M&A) activity, 2018-2020. (Source: GlobalData, Pharma Intelligence Center Deals Database (Accessed April 20, 2021) © GlobalData)

Specialist CMOs are experiencing increasing levels of acquisition as time goes on. During 2015-2017, acquired companies with specialized services accounted for 28% of deals, which grew to 33% during 2018-2020. Standard offering acquisitions decreased to 44% from 50% between 2015-2017 and 2018-2020. These trends suggest that PE firms are increasingly targeting companies with sophisticated capabilities to cope with the challenges of manufacturing modern drugs. There is evidence of this continuing into 2021, when Murano Bidco, an affiliate of PE giant Carlyle Group, acquired Vectura Group in May 2021 for $1.4 billion. Vectura develops inhalation products through an integrated inhaled drug delivery platform and demand for this specialist dosage form, inhaled drugs, may become more of a theme as the COVID-19 pandemic progresses, as many survivors suffer from long-term decreased lung capacity.

FDA approvals requiring special handling have generally increased in recent years. This trend bodes well for CMOs with specialist high-containment capabilities, as the regulations for associated facilities can be onerous and out of reach for small and mid-sized companies. As molecules become more complex, future production will require enhanced technologies for the expression, development, and manufacture of these molecules.

High-demand biologics

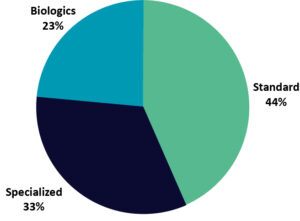

Figure 2shows that the largest target group had standard capabilities and lacked specialized, differentiating services, despite being less than half of the targets. The next largest group was specialized targets. Only 23% had capabilities that could be used in API-biologic (including cell and gene therapies) and dose manufacture. Although most CMOs would benefit from new or additional biologic and specialized capabilities, there is a relatively small number of associated facilities in comparison to those with a standard offering.

The cost of acquiring or constructing sites with biologic capabilities is prohibitively expensive. Biologics production and the supply chain are complex and require a wide array of often expensive equipment with a high level of staff expertise. Large-scale biotech manufacturing facilities cost from $200 million to $500 million to build, which is far more than small molecule facilities of similar scale, which usually cost about $30 million to $100 million to construct. Thus construction of a biologics facility will be financially restrictive for most companies except big pharma. Even after the construction and setup are completed, the running costs of biologic manufacturing facilities will also be far higher, requiring highly skilled staff and expensive materials and equipment while producing a limited yield. Overall, this means that many smaller pharma companies and CMOs will be unable to build or acquire such capabilities, and therefore CMOs with these capabilities can charge a premium to clients.

GlobalData’sNew Drug Approvals and Their Contract Manufacture – 2021 Edition report showed that the FDA approved more biologic New Molecular Entities (NMEs) in 2020 than in any other year in the previous decade. Simultaneously, sponsors increased the outsourcing of the manufacture of active biologics. However, as pipeline and marketed biologics increase in both complexity and number, most CMOs remain unable to manufacture biologic APIs to meet sponsor companies’ needs.Unfortunately for CMOs, larger companies tend to invest in developing their own internal manufacturing capabilities to manufacture drugs rather than outsource production. However, they do frequently dual source to mitigate risk and for other strategic reasons.

COVID-19 vaccines and advanced therapy medicinal product (ATMP) manufacturing are heavily outsourced due to scale or technical expertise difficulties. CMOs can benefit from investing in capabilities and expertise (where they have the means to do so) to produce and handle sensitive biologics, as the marketed drugs landscape will become increasingly flooded with these in coming years.

Cell and gene therapy-related acquisitions are currently in high demand and highly valued, with some of the largest CMOs being involved in these acquisitions, such as Catalent acquiring both MaSTherCell and Paragon Bioservices, for $315 million and $1.2 billion, respectively. At the same time, Massachusetts-based Thermo Fisher Scientific Inc, another leading CMO, completed its acquisition of Brammer Bio LLC, a viral vector contract development and manufacturing organization (CDMO), for $1.7 billion, while contract research organization Charles River Laboratories acquired Cognate BioServices, a cell and gene therapy CDMO, in a high-value deal in March 2021 worth $875 million.

Figure 2: Acquisition targets by sophistication of capabilities.

Source: GlobalData, Pharma Intelligence Center Deals Database and Contract Service Provider Database (Accessed April 20, 2021) © GlobalData

Note: Standard service offerings and processing technologies are common to the industry and not differentiated. Specialized service offerings use standard technologies but are applied in more complex products (excluding biologics), such as the manufacture of controlled or highly potent substances. Biologic service offerings and process technologies are not broadly available and are used for biologic drug categories such as monoclonal antibodies, proteins, peptides, gene therapies, or cell therapie

Future outlook: factors at play

The COVID-19 pandemic has led to investor hesitancy, even when it comes to M&A activity. However, some of the largest CMOs will continue to acquire to enhance their capabilities or scale of production in the future. Even during the height of the COVID-19 pandemic in 2020, large CMOs acquired companies, not only for high-profile capabilities such as gene and cell therapy manufacturing but also for more traditional commercial dose manufacturing services. There is no reason why this M&A activity cannot continue over the next two to three years.COVID-19 vaccine developers signed contract manufacturing agreements at an unprecedented rate during 2020 because many of these sponsors are small companies or non-profit institutions that lack manufacturing capabilities. Even the largest companies require extra capacity to supply billions of doses. Despite many developed markets vaccinating the majority of their populations, vaccine production will still remain in high demand for the foreseeable future.

COVID-19 vaccinations: more demand for CMO services

The US Centers for Disease Control and Prevention (CDC) and the FDA have announced a plan to offer the US general public a third shot of either Pfizer/BioNTech’s or Moderna’s COVID-19 vaccines. The FDA and CDC have also said that a second dose of the Johnson &Johnsonvaccine may also need to be administered, these possible requirements following a rise in the levels of the highly transmissible Delta variant of the coronavirus. The US is already administering a third dose to immunocompromised people, and Israel is also rolling out a third dose. Many European countries will offer a third dose to vulnerable groups.

Experts, including Andy Slavitt, former senior pandemic advisor to President Biden, have raised the possibility that patients who received the Johnson & Johnson or AstraZeneca recombinant vector vaccines may require an additional messenger ribonucleic acid (mRNA) vaccine shot due to the increasing prevalence of the more contagious Delta coronavirus variant, which studies suggest the Pfizer vaccine offers better protection against it.

The global prevalence of COVID-19 is still high. Most countries have not yet vaccinated their populations to an extent that herd immunity is achievable. Several variants have been identified. They developed a short time after the virus was discovered in late 2019, so it is a safe assumption that further variants (and potentially variants of concern) will emerge if case numbers remain high. While Pfizer and BioNTech believe a third dose of their vaccine (identical to the first two shots) would be effective against all currently known variants, including the Delta variant.In the future, if a variant emerges that is not prevented by the vaccine, Pfizer will develop a new version of its vaccine.

These extra doses will bring more highly specialized work, with CMOs making these novel molecules.It will also put pressure on the world’s supply chains. Other developments could push volumes even higher, including the fact that companies are currently trialing vaccinations in children and the likelihood that one or more vaccines or therapies currently in clinical development will be approved. If these candidates are found to be safe and efficacious, there will likely be a rapid increase in the number of contract manufacturing agreements.

Bibliography

- GlobalData (2021a) M&A in the Contract Manufacturing Industry: Implications and Outlook – 2021 Edition, GDPS0037MAR.

- GlobalData (2021b) New Drug Approvals and Their Contract Manufacture – 2021 Edition, GDPS0035MAR.

- GlobalData (2021c) COVID-19 Vaccines: Contract Development and Manufacturing Landscape, GDPS0034MAR.

- GlobalData (2021d) FDA OKs Third Dose for Pfizer and Moderna COVID-19 Vaccines: What Does It Mean for Manufacturing?,GDHC4122EI.

- GlobalData (2021e) BIO 2021: mRNA Vaccine Booster Shots for COVID-19 and Increasing Uptake Will Offer CMOs Lucrative Opportunities, GDHC4050EI.

- GlobalData (2021f) Rising Innovative Biologic Approvals Spell API Manufacturing Opportunities, GDHC3898EI.

- GlobalData (2018) M&A in the Contract Manufacturing Industry: Implications and Outlook – 2018 Edition, GDPS0024MAR.

The ninth edition of the CPhI Annual Report – a comprehensive report analyzing key trends and innovations in pharma – was commissioned by Informa Markets and will be available for download from www.cphi-online.com during CPhI Worldwide, which is being held at Fiera Milano, Milan, Italy, November 9-11, 2021.