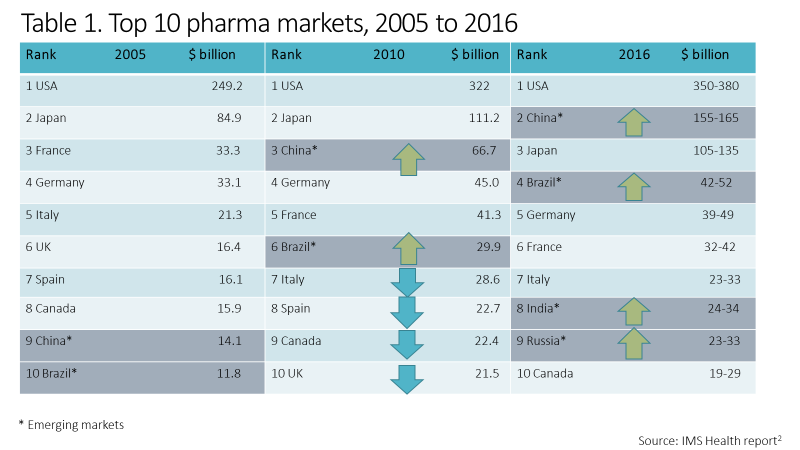

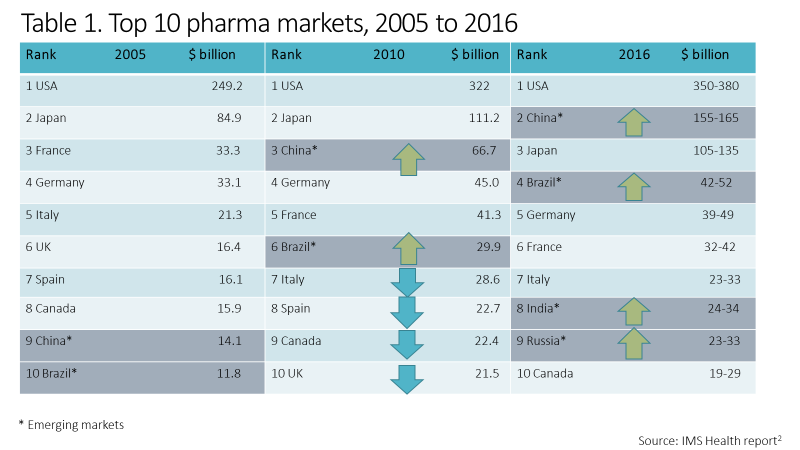

The rapidly growing markets in the Asia-Pacific, the CIS and Russia, Middle East, Latin America and Africa offer significant opportunities for pharmaceutical companies who are willing to turn their gaze from the bright lights of the US and old Europe. Probably the greatest potential for these opportunities lie in countries like China, Brazil, India and Russia. However, those with an eye on the future may also look at Algeria, Argentina, Bangladesh, Chile, Colombia, Egypt, Indonesia, Kazakhstan, Mexico, Nigeria, Pakistan, the Philippines, Poland, South Africa, Saudi Arabia, Turkey and Vietnam.

Therapy areas expected to show particularly strong growth on a global scale up to 2022 include immunosuppressants (predicted CAGR 14.6% from 2017 to 2022), oncology agents (12.7%) and dermatological products (11.2%). Reflecting this, the world’s current top-selling product, Humira (adalimumab; an anti-tumour necrosis factor alpha monoclonal antibody by AbbVie and Eisai) is expected to retain is top ranking position from 2017 through to 2022, closely followed by Revlimid (lenalidomide; an immunomodulator by Celgene). Both products are predicted to show worldwide sales of around $15 billion by 2022. This is a staggering figure but, put into perspective, the top 50 selling products are all expected to exceed $2 billion in sales within the next 5 years.

However, when we look at emerging markets, a different pattern is seen. In these regions, the top therapeutic areas in 2018 are expected to be pain, antibiotics, hypertension, oncology and diabetes.

Greater expenditure in these areas is being driven by increases in economic development, which are providing improvements in healthcare systems, infrastructures and awareness of both diseases and the availability of treatments. While emerging countries still show a greater proportion of private expenditure on healthcare (versus government funded healthcare) compared with the G7 countries – excluding the USA – there is growing government support in emerging markets for improving health care systems. For example, China has introduced reforms that will provide “affordable medical care for all” by 2020, and Russia has announced 2020 reforms that will extend basic healthcare coverage and reimbursement for outpatient drugs. India has also announced plans to increase government health expenditure by at least 2.5%of GDP by the end of 2018.

Currently, the top ten drug makers in emerging markets comprise global majors: Bayer, Merck, Novartis, Novo Nordisk, Pfizer, Sanofi, GSK, Johnson & Johnson, AstraZeneca and Roche.

However, as home-grown companies recognise local opportunities, a number are capitalizing on the growing pharma markets in their regions. The five largest emerging markets’ drug-makers, in terms of sales volume, are KALBEFARMA (Indonesia), SAMSUNG BIOEPIS (Korea), DHG Pharm (Vietnam), CELLTRION (Korea) and Indopharma (Indonesia).

To compete in the emerging markets, you need to clearly define your long-term strategic objectives, diversify your risk and prioritize your product portfolio. Striking the right balance between internal resources and market demands, and capturing out-of-pocket and consumer markets in these regions, may provide significant rewards to companies with sufficient agility to respond to emerging market needs.

Here are my top five tips for winning in these markets:

- Develop effective and rapid execution capabilities

- Find synergies between internal resources and capabilities with locally relevant elements

- Diversify your risks in terms of product markets

- Think separately to rebalance activities when volatility occurs

- Be aware and keep up to date with local regulatory, legal, marketing and distribution issues.

With these points underlying your strategy, the world’s emerging markets offer a multitude of opportunities for the pharmaceutical sector.

References

1. Evaluate Pharma. World Preview 2017, Outlook to 2022. June 2017 (info.evaluategroup.com/rs/607-YGS-364/images/WP17.pdf)

2. IMS Institute for Healthcare Informatics. The Global Use of Medicines: Outlook Through 2016. May 2012 (apps.who.int/medicinedocs/documents/s20306en/s20306en.pdf)

Author:

Nicola Travierso, President of Velit Bio, 1010 Wien – Wollzeile 1-3/3/3.2, Austria