Nutraceuticals

A brief analysis of China’s leading vitamins manufacturers 14th February 2018

By Patrick Schreiber, Marketing & PR Executive at Kcomber Inc

Kcomber Inc’s Patrick Schreiber analyses the top players in China’s vitamins industry, and its impact on the world market.

China started production of vitamins in the 1950s, and grew steadily to become the largest producer and exporter of vitamins worldwide by the early 21st century. With some Chinese companies owning global vitamin market shares of 50% or more, the development of China’s industry plays a key role in the worldwide market.

China mainly exports low-priced vitamins such as vitamin active pharmaceutical ingredients (API). Most of the products are exported to the USA, Malaysia, Germany, Japan, the Netherlands, and Vietnam for further processing. With the export volume of vitamins continuously increasing, the overseas markets are ever more important for manufacturers in China. Demand changes from overseas markets can have a significant impact on vitamin prices in China, adding further to the sharp fluctuations seen in recent years due to supply shortages and environmental protection pressures.

Looking at the Chinese vitamin industry itself, fierce competition and progress of production technology have been pushing the industry to be more centralized in recent years. Some big enterprises such as Northeast Pharmaceutical Group, North China Pharmaceutical, Zhejiang Medicine, Zhejiang NHU and Zhejiang Hangzhou Xinfu Pharmaceutical are dominant and can easily influence the price trend of vitamins in China. Hence, it is inevitable to track China’s leading vitamins manufacturer when doing business in this market.

China’s top vitamin enterprises

Market intelligence firm CCM revealed a list of China’s top 500 enterprises in December 2017. In this list were 33 pharmaceutical enterprises, with two vitamin manufacturers among them. The two most successful vitamin enterprises are CSPC Pharmaceutical and Zhejiang NHU.

CSPC Pharmaceutical

Headquartered in China’s Hebei Province, close to the Chinese capital Beijing, CSPC Pharmaceutical Group Limited is the world’s largest vitamin C producer. Besides vitamin C, the company produces caffeine, ampicillin, penicillin and amoxicillin. The enterprise has been one of China’s 500 Most Valuable Chinese Brands and Top 500 Chinese Enterprises for many years. CSPC, which states a vitamin C API production of 30,000t/a to 40,000t/a, benefited from a large vitamin C price rise in 2017, caused largely by decreased output of China’s vitamins in 2017, resulting from the stringent environmental policies and limitations for production processes.

CSPC also suffered production cuts in 2017, which pushed up the price of vitamin C. CCM is of the opinion that the situation is unlikely to change in the near future, further decreasing supply and pushing up prices. Most of the provinces in China have issued their environmental protection tax amounts successively, with regions like Hebei recording some of the highest taxes. The new Environmental Protection Tax Law will come into effect in 2018. CPSC Pharmaceutical, located in Hebei Province, has adjusted its strategies from API to new medicines.

Vitamin producers are likely to be the key targets of environmental supervision in China. In May 2018, CSPC had announced that one of its subsidiaries will acquire all equities of CSPC Defeng for almost US$10 million. On the other hand, the company had announced in April 2017 that it may spin off CSPC Innovation Pharmaceutical and other subsidiaries listed in the A-share market.

Zhejiang NHU

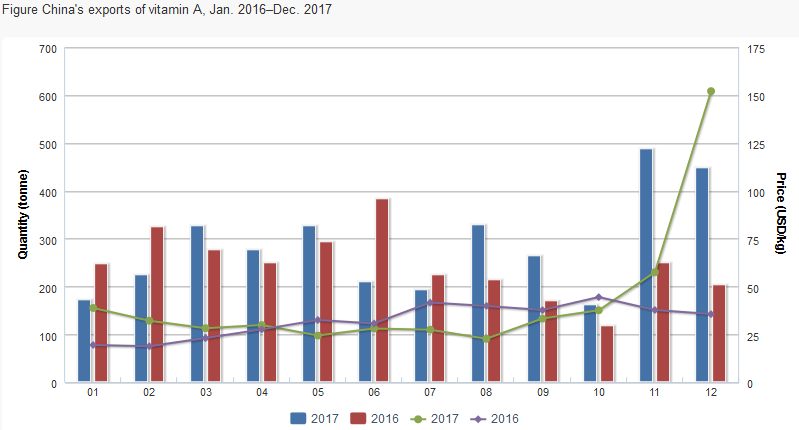

Zhejiang NHU is China’s leading vitamin A producer. The company also produces a significant share of vitamin E for the world market. As one of the leading producers of vitamin A, the company is enjoying high market prices at the moment. In October 2017, the price reached an historical peak, resulting from tight supply. CCM predicts that the vitamin A price will continue rising in the near future.

Zhejiang NHU is also a leading producer of biotin. This raw material for feed additives and pharmaceuticals witnessed price hikes in 2017 as well. In the first half of 2017, the company revealed a financial report which showed a revenue of more than US$388 million, which represented a growth of 13.26% and a net profit of US$87, up by 13.62%. The improvement was attributed by company officials to higher prices and increased sales of some leading products.

Recently, the company announced that it plans to merge with its wholly-owned subsidiary Zhejiang Xinweipu. After the merger, the enterprise will take over all of business, assets, debts, and rights of the company. As vitamin prices are increasing, Zhejiang NHU, as an industry giant, will achieve a turnaround in the loss-making businesses of Zhejiang Xinweipu. In May 2017, Zhejiang NHU disclosed that it had 25,000t/a vitamin E powder and 6,000t/a vitamin A powder. The company furthermore started a methionine project with a capacity of 50,000t/a, of which about 70% is already operated at full capacity at the end of 2017.

Environmental pollution pressure

China’s government has taken actions to counter air pollution caused by winter heating. This especially affects the vitamins industry in Northern China, which is one of the highest polluting regions in the country. Reduced supply and higher prices are the results of such measures.

Enterprises that are buying pharmaceutical products from China should inform themselves if their suppliers are affected. Supplies from China might be limited and prices could climb to a higher level when inventories run low.

Winter heating in the northern part of China traditionally ranges from November to March. Hence, many high-polluting industries are forced to suspend production during this period, to counter the high pollution caused by heating. Many enterprises are not allowed, or only partly allowed, to produce drugs and pharmaceutical products for about 4 months in total, which is one-third of the total year.

Cancelled the inspection and quarantine of vitamins

What’s more, the General Administration of Quality Supervision, Inspection and Quarantine announced in late January 2018 that it would cancel the inspection and quarantine of vitamins food grade and feed grade for export, starting 1 February 2018.

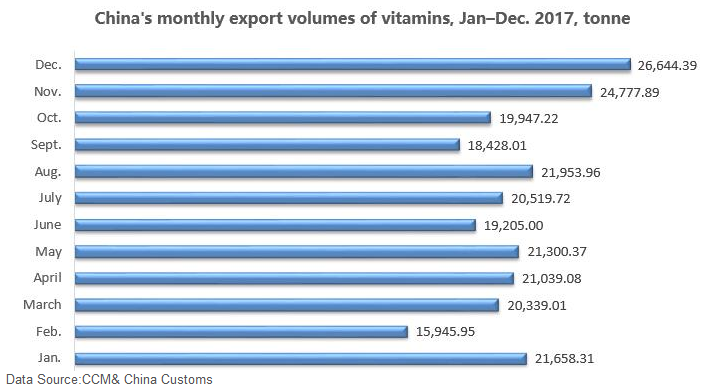

China is currently the world’s largest vitamin producer and exporter, but the pretty high export costs and complicated customs procedures dampened the enthusiasm of producers and traders. According to the China Customs, China exported a total of 251,759 tonnes of vitamins in 2017, up 13.47% year on year. The cancellation of export commodity inspections will reduce the costs of exporting producers, and the simplified procedure will also benefit traders. CCM holds that this will stimulate the export of vitamins in China in 2018.

Author:

Patrick Schreiber, Marketing & PR Executive at Kcomber Inc, 17th floor, Huihua Commercial & Trade Building, No. 80 Xianlie Zhong Road Guangzhou 510070, P.R. China

T: +86-20-6293 8903; E: patrick.schreiber@kcomber.com