Materials Science

Acetic acid set for substantial growth 29th November 2017

By Global Market Insights

Global Market Insights (GMI) analysts explain how the acetic acid market us expected to amass heavy returns from purified te

Global Market Insights (GMI) analysts explain how the acetic acid market us expected to amass heavy returns from purified terephthalic acid (PTA) applications, shifting trends toward bio-based products to fuel industry growth from 2017-2024.

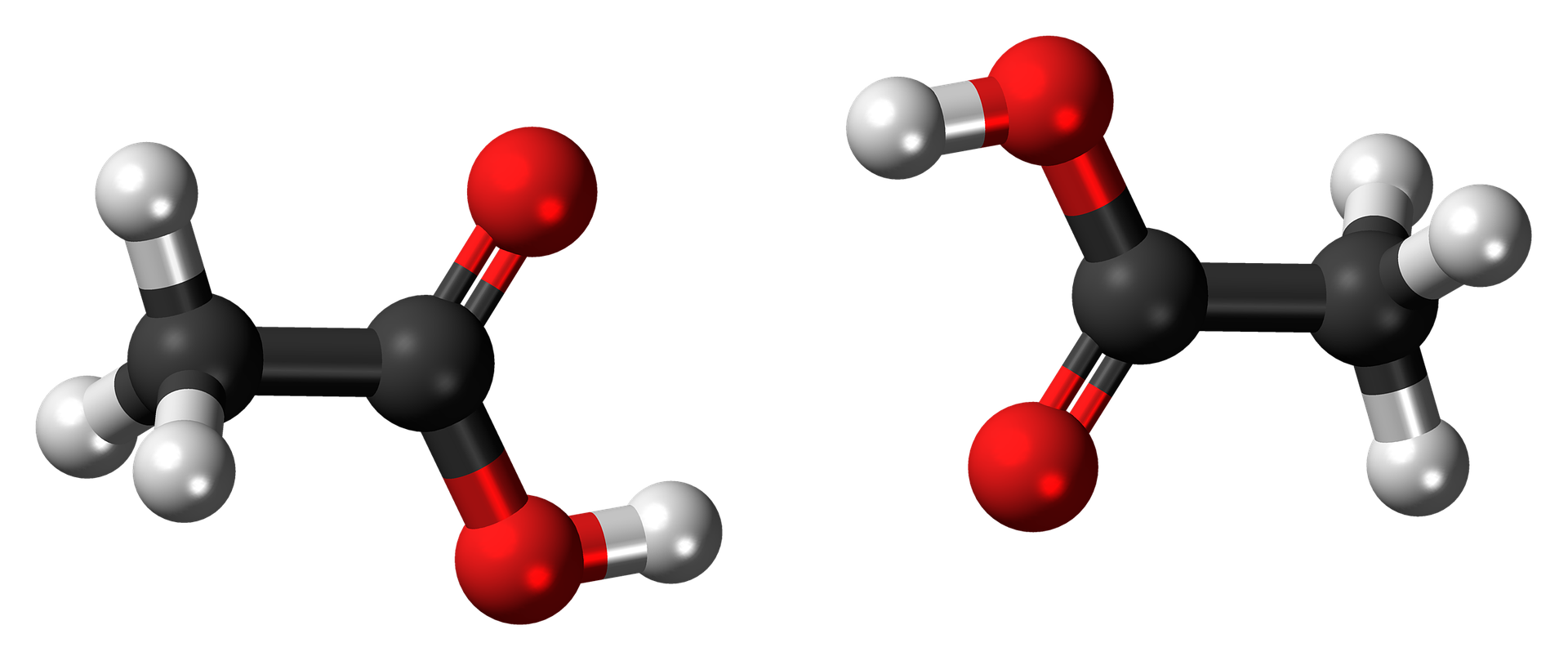

The vast expanse of the application spectrum of the acetic acid market can be primarily credited for the extensive growth of this business space. While acetic acid is liberally deployed in medicine, food additives, perfumes, inks and dyes, it is also one of the few versatile organic chemicals that finds utilization in the manufacturing of adhesives, paints, fibres and resins. Given its widespread deployment across myriad end-use domains, numerous oil refineries have been making substantial investments to establish acetic acid plants – a move that may have a noticeable impact on the acetic acid industry.

The British energy company, BP for instance, and the Oman Oil Company, have recently collaborated to form a joint venture for developing an acetic acid production plant at Sultanate with an estimated investment of $1 billion. The move, in all probability, may have quite an impact on the regional acetic acid market share in the years ahead, though globally, the valuation of this vertical was pegged at $8.6 billion in 2016. Citing another instance, the public-sector oil company, Numaligarh Refinery Limited (NRL), recently announced plans to establish its bio-refinery in Assam, India, through which the firm is looking to produce 49,000 tons of bio-ethanol while simultaneously co-producing acetic acid. Investments in acetic acid production plants such as these are likely to provide a major boost to product sales, thereby impelling the revenue graph of acetic acid industry, anticipated to surpass a valuation of $16 billion by 2024.

The continent of Europe is quite an active player in the geographical landscape of the acetic acid market. Recently, the European Parliament upheld a decision to ban the use of herbicide glyphosate for household purposes post-2018, and for agricultural applications post-2024, taking into account the health issues associated with glyphosate. In consequence, it is more than likely that acetic acid may be used as a viable alternative for integrated pest management, which would considerably propel Europe acetic acid market, slated to cross a valuation of $2.4 billion by 2024.

Furthermore, Europe’s acetic acid industry outlook is slated to be influenced by the robustly expanding food and beverage (F&B) sector in the region, especially across Spain, Germany, and Italy. The F&B packaging domain requires the application of polyester fibre, PET resins, and polyester films, the production of which demand the deployment of purified terephthalic acid (PTA) – a major segment of the acetic acid market. In consequence, this would create a widespread demand for PTA in Europe, inherently augmenting acetic acid industry size from PTA applications, which held a valuation of $2.5 billion in 2016. With frozen and packaged foods gaining mass prominence in Europe and numerous other geographies, the demand for PTA in the region is only forecast to increase in the years ahead. In fact, as per estimates, PTA held more than 25% of the overall acetic acid industry share in 2016, and accounted for a market size of 3,545.6 kilo tons in terms of volume in the same year.

Acetic acid market, as per analysts, has been forecast to garner substantial value from the medical sector as well, pertaining to the widespread deployment of acetic acid for manufacturing antiseptics and cancer treatment medicines. For instance, in order to diagnose cervical cancer, which currently ranks as a major health issue, WHO has recently approved a study that focuses on visual inspection with acetic acid for early prevention of cervical cancer. As per estimates, close to 12,820 women will be detected with cervical cancer across United States by the end of 2017. The increasing prevalence of this dreaded disease is likely to impel the demand for VIA (virtual inspection with acetic acid) for initial screening of cancer, which will further influence acetic acid industry trends, especially across North America. The region, as is analysed, seems to be a rather profitable avenue for the growth of acetic acid market, driven by the heavy deployment of the product across the rapidly expanding medical sector. Statistics claim that North America acetic acid market share was pegged at 1900 kilo tons in 2016. The NIH has also been favoring screening and treatment methods for reducing the occurrence of cervical cancer and mortality, which would further impel the regional business space. In fact, estimates state that North America acetic acid industry size to cross a valuation of USD 2.5 billion and 2,697 kilo tons in terms of revenue and volume respectively, by 2024.

Speaking along similar lines, with respect to the medical perspective in question, it is prudent to mention that in the year 2015, researchers from Microbiology Research Centre (SRMRC), National Institute for Health Research (NIHR), and the University of Birmingham had investigated the antimicrobial properties of acetic acid, that depicted profound effectiveness against bacteria in burns. Considering that infected burn wounds are rather difficult to treat with traditional antibiotics, acetic acid is now being used to treat the same, given its highly antiseptic and antimicrobial activities. The product is also used as an agent in several medicinal combinations to kill bacteria and prevent infections such as Streptococci, Staphylococci, Pseudomonas and Enterococci. Not surprisingly, acetic acid market size from medical applications is anticipated to witness a noticeable growth rate over the years ahead.

The depletion of fossil fuels is becoming a global issue of concern lately, given their massive applications in the industrial arena. However, the excessive deployment of fossil fuels has also had a damaging impact on the environment, which has led to companies striving to develop bio-based alternatives. Following the heels of this trend, most of the giants in acetic acid industry are focusing on the development of bio-based acetic acid, rather than petroleum-based feedstock. The bio-based alternatives, apparently, are rather cost effective and reliable, and can be liberally deployed in medical and F&B applications. In the years ahead, the growing utilization of such bio-based products is slated to outline a significant ration of the product landscape of acetic acid market, which as per Global Market Insights, will record a CAGR of 8.7% over 2017-2024.

The full report by Global Market insights can be found at https://www.gminsights.com/industry-analysis/acetic-acid-market