Oilfield & Energies

Bioethanol export challenges 19th December 2018

By Monty McCoy, Director of Technology at U.S. Water

Monty McCoy, Director of Technology at U.S. Water explains how bioethanol production is being optimized to address challenges crea

Monty McCoy, Director of Technology at U.S. Water explains how bioethanol production is being optimized to address challenges created by inconsistency in quality specifications and variations in the methods used to guarantee them.

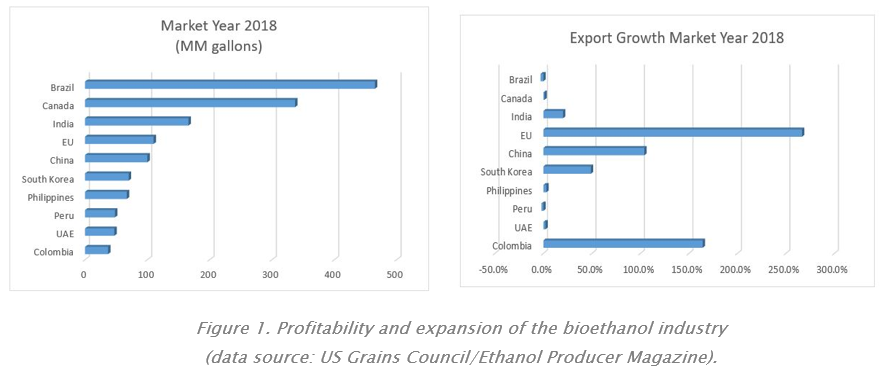

US ethanol exports increased from 89.9 million gallons in September to 175.4 million gallons in October, posting a 95% increase, according to data released by the US Department of Commerce and analyzed by the Renewable Fuels Association. Exports continue to set records (1.45 billion gallons in market year September 2017-August 2018), as expansion of the volume of ethanol exported to the rest of the world is critical to profitability and expansion of the industry (Figure 1).

However, further growth can be limited by challenges created by inconsistency in quality specifications and variations in the methods used to guarantee them.

Large foreign consumers are expanding their import volumes and additional nations are engaging with United States ethanol producers as global restrictions to grain-based ethanol are relaxing. Export opportunities have established value to the United States industry as market years 2017 and 2018 both set export records. Exports have enabled US ethanol plants to continue to operate at full capacity or to expand with higher profitability.

The following excerpt is from Renewable Fuels Association, December 6, 2018:

“According to RFA analysis, American producers shipped 91.4 million gallons of denatured fuel ethanol in October, a 35% increase and the highest volume on rescord. Despite a 7% decrease from the prior month, Canada retained a sizable lead as our top customer at 30.4 million gallons, or 31% of our export market for denatured product. October exports of US undenatured fuel ethanol were 79.7 million gallons, a more than 400% increase after dipping to 13.4 million gallons in September. Brazil accounted for more than half of the market, 41.5 mg or 52%, and India again took record 24.6 million gallons for 31% of global sales of US undenatured ethanol.”

According to research conducted by the US Grains Council and Ethanol Producer Magazine, these changes are visible on a global level. Mexico has approved E10 for most of the country and is currently averaging 32.3 million gallons per year of imported US ethanol. Canada is considering allowing E15 and E85 nationwide, following Ontario’s lead, and is currently averaging 337 million gallons per year of imported US ethanol. Brazil is reviewing their 20% tariff on imported US ethanol in excess of 159 million gallons per year and is currently averaging 465 million gallons per year of imported US ethanol. Southeast Asian countries are working with the United States to grow their imports including Australia, Bangladesh, China, India, Indonesia, Japan, Korea, Malaysia, Myanmar, New Zealand, Pakistan, Philippines, Singapore, Sri Lanka, Taiwan, Thailand and Vietnam. Notably, India is experiencing rapid growth in industrial applications of US ethanol. Japan is converting from sugarcane-based oxygenate to starch-based ethanol for production of ethyl tertiary-butyl ether (ETBE). Previously, Japan’s fuel policy only allowed sugarcane-based ethanol to be imported for the production of ETBE. Japan has also mandated emission reduction by increasing ethanol usage from 50% to 55%. This policy also approves US ethanol for meeting this target and allows up to 44% of Japanese demand which could mean 95 million gallons per year. And lastly, China is offering significant volume opportunities if the tariff situation is favorably resolved. Currently, the US is locked out by a 70% Chinese retaliatory tariff. China has imported zero gallons since March. However, the potential exists to export 5 billion gallons per year to China by 2020, should the trade battle end.

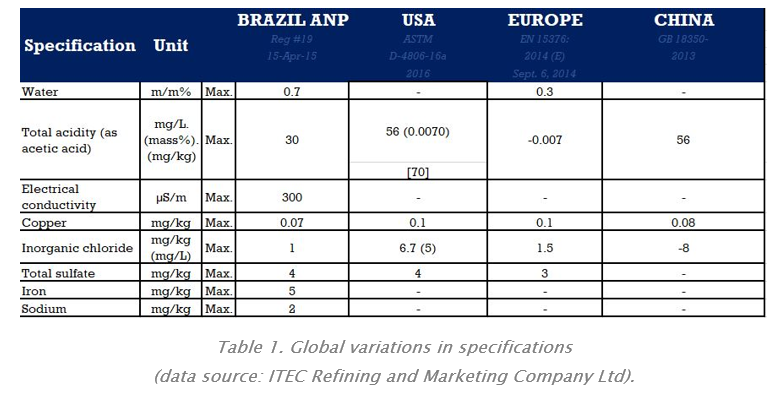

Ethanol exporters are impacted by three significant factors, which differ from “normal” domestic production requirements. These are specification and methodology variations, and the wide variety of uses of ethanol in foreign countries. New, revised, tighter national and/or buyer specifications necessitate understanding of the new requirements. Once the new requirements are understood, modifications in plant operations may be necessary to achieve them. Shipments can be rejected if they fail to meet specification – an expensive circumstance. Changing methodology, complicated by translation, can result in confusion. As an example, one overseas procedure for testing translated as “…first you build a small fire” when the intent was “…heat the sample”. In that case it was obvious that you don’t heat ethanol with a flame, but other more ambiguous mistranslations can slip by and impact cooperation.

Not only is fuel ethanol impacted by these impediments – specifications and methodology also vary with ethanol end-use. Let’s use Brazilian and Asian grades as examples. Brazilian Hydrous Ethanol Fuel (undenatured) directly supplies the engines of vehicles. Standard Hydrous Ethanol is intended for domestic use and ether production in Brazil. Japanese and Korean Standard Hydrous Ethanol have the same use as the Brazilian Standard, with Japan having the highest quality with the greatest import demand, and Korea having intermediary quality with high demand for import. Alcoholic distillate is used in the production of alcoholic beverages and is produced by mixing standard hydrous ethanol with demineralized water, yielding a product of lower alcoholic content than the hydrous ethanol. Anhydrous Ethanol Fuel is used as an additive in gasoline mixtures. Lastly, Industrial Grade Anhydrous Ethanol is used in formulas of cleaning products and by the chemical industry for production of paints and varnishes.

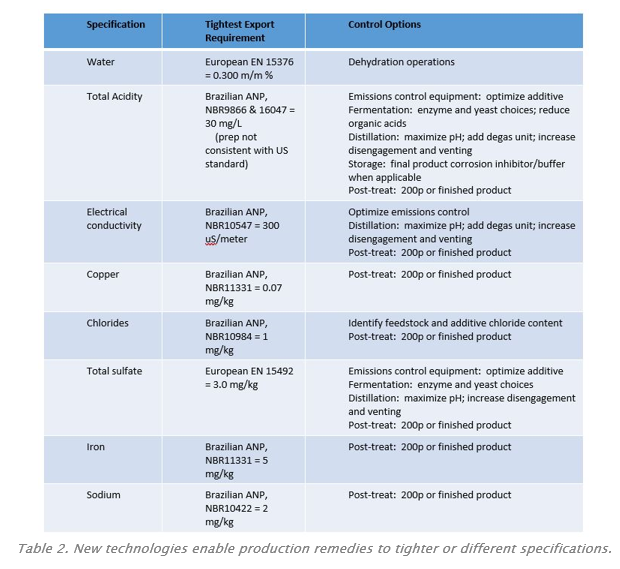

Satisfying export requirements complicate plant operation. Due to dehydration unit operation, plants slow production rates to create lower moisture “dry product”. Product grades must be sequestered – US contracts must still be satisfied and there are only so many tanks to store distinct products. Blending decisions and process management become problematic. Quality-at-manufacture does not guarantee quality-at-delivery. Ethanol quality can decline in transit. Product can be contaminated during loading or by previous cargo. The tanker may have corrosion residues; and further corrosion can occur during transit. Acidity may increase and pHe may decrease with time and oxidation. Likewise, time and oxidation drive existent sulfate levels higher toward the potential sulfate level, possibly exceeding existent sulfate spec on delivery. On occasion US production has been locked out of some export opportunities due to current limitations on product quality. However, important new technologies enable production remedies to tighter or different specifications thereby breaking a “lockout” due to quality limitations as shown in Table 2.

As international specifications and test methods vary from country-to-country and by application, the fuel ethanol industry continues its reliance on innovation to meet the demands of the emerging export market. Specifications can be better understood, and production optimized to overcome limitations. While challenges to the producer remain, fruitful and developing export opportunities have established value in our industry by operating plants at full capacity and more profitably. These opportunities also support a global view toward “green” energy sources. Major importers are escalating their import footprint and additional nations are engaging in importing ethanol. Even the previous restrictions to grain-based ethanol are relaxing. For these reasons, recent years have set US ethanol export records. There is also great potential in the export volumes achievable by capture of the potential China and Mexico markets while continuing growth in the current global marketplace. Although future growth can be limited by challenges created by inconsistency in quality specifications and variations in the methods used to guarantee them, production is being optimized to conquer these challenges.