Agrochemicals

China’s glyphosate industry is looking at prosperous development 20th November 2017

By Patrick Schreiber

Kcomber Inc’s Patrick Schreiber looks at the long-term prospects for China’s glyphosate industry, and its impact on the

Kcomber Inc’s Patrick Schreiber looks at the long-term prospects for China’s glyphosate industry, and its impact on the world market.

Glyphosate, the key active ingredient of the famous weed killer Roundup, is one of the most commonly sold herbicides in the global market today. With rapidly increasing demand, glyphosate has more than 30% of the global herbicide market share, in terms of sales volume.

When looking at the global glyphosate market, it is important to look at China, given that the People’s Republic has evolved into the largest production base of this herbicide in the world, and accounts for more than 70% of the global production. This also implies that every change in China, especially regarding price and supply, has a massive effect on the world market.

The top 10 major export destinations of Chinese glyphosate, technical and formulations, are the USA, Brazil, Argentina, Nigeria, Thailand, Russia, Vietnam, Indonesia, and Ghana (Figure 1).

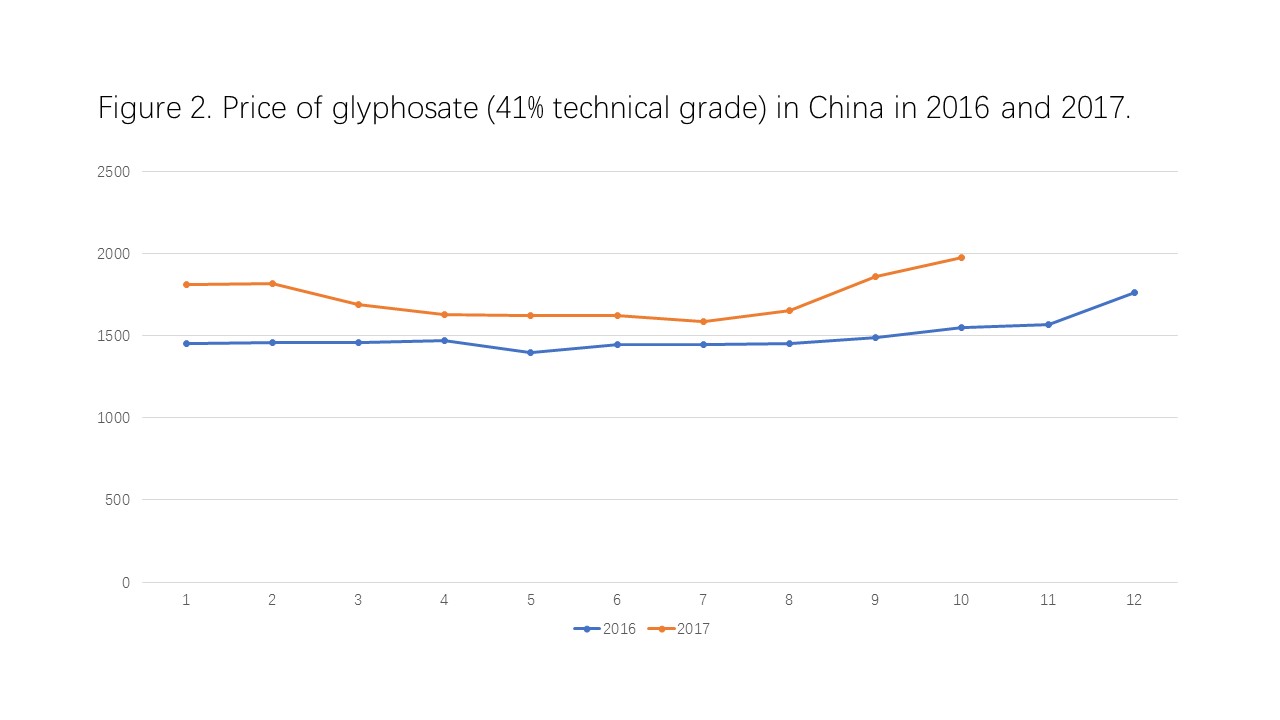

Chinese glyphosate prices rise

The last round of China’s environmental inspections was launched in the middle of August 2017. The centre of these inspections has been Zhejiang, Shandong, and Sichuan, which represent the main regions of China’s pesticide production (more than one-third of national output). According to market intelligence firm CCM, the increased environmental investigations in China will undoubtedly increase pressure on manufacturers, negatively affecting the supply of glyphosate and its raw material, which in turn support current price hikes of glyphosate in China.

The current prosperous state of China’s glyphosate industry is mainly due to the decreased inventories of many manufacturers, as well as the ban on paraquat AS in the country, which lead many clients to switch to glyphosate as a replacement. In July and August 2017, when production was further restricted, another round of price rises swept throughout the entire glyphosate market (Figure 2).

Another factor that may keep the international glyphosate prices – and the prices of other pesticides – high is the trend for mega-mergers between huge agrochemical companies. Notable are the mergers of ChinaChem with Syngenta, Dow Chemical with DuPont, and Bayer with Monsanto. The large mergers will without any doubt reshape the current global agrochemicals and seed market, with fewer but stronger enterprises controlling prices and supplying pesticide products for the world market. The huge enterprises do sell their genetically-modified seeds and promote the pesticides that are working well together, like Monsanto’s famous glyphosate containing Roundup. When fewer enterprises control the seeds and related pesticides, the supply and price competition may fall, which could keep prices high as a result.

China’s condensing glyphosate industry

The development of China’s glyphosate industry started to boom in 2007 and continued surging until 2009. After that prospering period, a recession kicked in, which wiped out about 90% of China’s glyphosate producers at that time. While China’s economy was on a downward trend, the price of glyphosate still rose, due to the high industry concentration.

In 2014–2015, domestic capacity increased by about 300,000 tonnes per year, as more companies in China re-joined the glyphosate businesses. This directly caused serious overcapacity, making the market highly competitive.

However, since 2016, tightening environmental policies led to tension in the supply of glyphosate TC, and therefore pushed up the prices again. In fact, after two years of adjustment, plus the stringent environmental measures, the number of glyphosate enterprises in smooth operation has reduced markedly.

Future expectations

In the near future, CCM expects domestic glycine prices to further increase, given continuously strict environmental regulations in the leading producing provinces. Glycine is one of the main raw materials in the production of glyphosate. Particularly, Hebei, which states a glycine production capacity of 240,000 tonnes per year, and hence represents 40% of the national capacity, may experience heavier environmental pressure and longer production suspension.

At the Agrochemicals Exhibition in Shanghai (ACE) 2017, industry insiders shared their thoughts and opinions about the glyphosate future in China, and the general view was that increasingly stringent environmental policy will become the new norm, which probably affects more than 60% of the total glyphosate capacity in the country. As environmental pressures increase, glyphosate prices will be boosted. Although some enterprises will be impacted, those that are up to required environmental standards will show their competitive advantages.

Business transformation and upgrading were also keywords at the ACE 2017. Many industry insiders believe that the domestic situation will urge enterprises to make transformation and upgrading. With policies such as the new Regulations on Pesticide Administration, the markets and technologies provide the right conditions for transformation and upgrading.

What influences the glyphosate industry in China?

Low labour costs in China, in combination with lower production costs than the global average, are two beneficial factors for the further development of the industry. Furthermore, many farmers in China and developing countries worldwide are enjoying rising income, which boosts their purchasing power and increases demand for weed killers like glyphosate. Since the modernization and implementation of sustainable agriculture is one of the main goals in many developing countries, the demand for glyphosate for effective crop protection will further increase in the future and support the positive development in China

On the other hand, the overproduction of glyphosate in China has led to a severe overcapacity, which is pushing the price under the real value. In addition, higher environmental costs in China are putting pressure on manufacturers and limiting the profits that can be made. Higher export prices as a balance are difficult since there is little brand recognition for China’s glyphosate products overseas, which forces manufacturers to sell their products at a low price.

Challenges and opportunities

One of the major challenges of glyphosate is the development of genetically-modified crops. These crops are the main application scope for glyphosate and the trend is still hard to predict. Currently concentrated in the Americas region, the planting and using of GM crops is still highly controversial in many countries and the prospect is surely uncertain. Hence, the planting area is currently not increasing significantly which limits the growth of demand for the near future.

The other main challenge of the industry is the government’s strict environmental protection policy, which requires manufacturers to invest in costly waste treatment systems and forces them, to limit or halt production in some cases. With this strengthened supervision, profits remain to be small and the companies with the latest technology are leading the field.

A major opportunity for Chinese glyphosate manufacturers lies in cooperation which international players. Given the low production technology, most manufacturers are still focused on producing glyphosate technical and exporting this to overseas enterprises which process it further to glyphosate formulations. Cooperation with international players can grant manufacturers the sales channels and marketing expertise to get their products easier to clients around the world. However, this would also limit the further development of glyphosate formulations in China and keep the country as a raw material exporter rather than creating more value in the own country.

Some glyphosate producers have realised integration of the industrial chain, especially raw materials’ supply, formulation development and the establishment of sales network. The players possessing a complete industrial chain are more effortless to survive the coming fierce competition. Furthermore, many companies in China’s glyphosate industry, especially the small ones and those in bad financial situation, may face mergers or acquisitions in the coming two or three years.

Author:

Patrick Schreiber, Marketing & PR Executive at Kcomber Inc, 17th floor, Huihua Commercial & Trade Building, No. 80 Xianlie Zhong Road Guangzhou 510070, P.R. China

T: +86-20-6293 8903; E: patrick.schreiber@kcomber.com