Agrochemicals

NEW OPPORTUNITIES IN CROP PROTECTION MARKET 11th March 2022

By Glenn Carroll, Ph.D., President, Carroll Chemical and Consulting Enterprise LLC & Derek Oliphant, founding partner at AgbioInvestor

Established in 2017, AgbioInvestor offers Pharma CMOs and fine chemical players intuitive and interactive methods of accessing crop protection market data.

The global market for crop protection chemicals increased by almost 9% in 2021 and now exceeds $65 billion, with the industry having grown in recent years driven in part by rising food demand in the face of a rapidly-increasing world population. In addition, the industry proved extremely resilient in 2020 and 2021 in the face of the ongoing global pandemic, which has severely affected other industries.

Are you a Pharma Contract Manufacturing Organisation (CMO) or fine chemicals company thinking of expanding into this growth market, but do not know where to begin? AgbioChem has been developed by AgbioInvestor to help companies identify agrochemical active ingredients (AIs) and intermediates that fit their existing technology/asset portfolio, target new customers and boost profitability/return on investment. For those companies currently supplying crop protection chemicals, AgbioChem can further improve your strategy by providing previously unknown targets, which are synergistic with current product portfolios.

Whilst there have been a number of relatively high-profile regulatory issues surrounding certain crop protection AIs, in the main this has focused on older low-cost commodity products, such as glyphosate and chlorpyrifos. The removal of older commodity products has opened up the market to more recent introductions, where margins are generally more favourable. AgbioChem allows for the identification of key chemical technologies and synthetic pathways for leading crop protection AIs, with market information also available to identify volumes, prices and key companies involved in these AIs.

The crop protection market is expected to develop further in the coming years, benefiting from a number of key factors, including: increased demand for food and feed from rising populations; increased technification and product usage intensity in developing markets, notably in Eastern Europe and Asia; and a shift in product application strategies related to pest resistance development.

Newer technologies have been more important in driving growth for the crop protection industry, being driven by the need to replace older more toxic and less environmentally- sound technologies, which are being regulated out of key markets, as well as the need for new chemistries and modes of action to control pests, which have developed resistance to existing technology. Such active ingredients are typically lower volume and higher priced compared to older introductions, often representing strong supply opportunities for CMOs and fine chemical players with aligned chemistry.

Many CMOs and fine chemical companies have expressed interest in the agrochemical market, but did not know how to approach it. Who should they target? What could they produce? Would it be profitable? AgbioChem enables a user to find AIs/Intermediates that match their technologies within a price and volume range, thus allowing them to target higher value/lower volume materials or higher volume actives based on their asset requirements. Target customer lists are generated by providing the AgChem companies who sell the identified AIs.

AgbioChem details the intermediate ring structures and synthetic steps for all of the most commercially significant AIs (>125) in the crop protection market. As shown in the TableView screenshot, the database covers the technology and key reagent used, ring type, intermediate name and chemical structure. In addition, the main companies involved are listed for each AI. The database is accessed by AI, technology, reagent/material, ring type, AI type and technical price.

AgbioChem is a new tool that provides a number of features unique to the industry: each AI synthesis is first divided into chemical rings (see SynthesisView screenshot), which are further broken down into searchable reaction steps, whilst searchable market information for each AI allows for analysis of whether the AI/intermediate meets financial targets. This combination of insight, covering both chemical/technical information and market information, allows the user to answer several critical questions in the decision-making process, including:

Which AIs and chemical intermediates fit my technology set?

Am I maximising my asset profitability?

Are there higher value targets I should be focusing on?

Does my technology portfolio match my customer needs?

Is there a better customer mix?

Which adjacent technologies should I add?

Should I adjust my strategy?

Which acquisitions would generate the most profitable synergies?

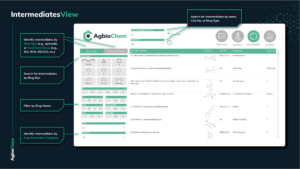

AgbioChem can also assist fine chemical companies with no interest in producing AIs: as crop protection chemicals typically have many more common intermediates than the Pharma Industry, with a single intermediate often used to produce multiple AIs, whose volumes are much larger than those in Pharma, and the volume of these intermediates can be incredibly significant. As shown in the IntermediatesView screenshot, AgbioChem helps companies identify these intermediates, as well as the raw materials used to produce them.

AgbioChem also highlights reagents and technologies used to produce crop protection materials, enabling reagent producers to expand their market. By providing technologies used to produce various AIs, chemical companies can identify market segments where the development of innovative technologies would be attractive. For example, an enzyme or catalyst developer could identify reaction types to focus on.

The unique inclusion of market data, together with chemical/technical information, provides an extra level of intelligence, giving a complete overview of both the required synthesis processes for each step of manufacture, as well as the available market (value, volume, technical price) and leading companies with involvement in each AI.

Market data is provided by AgbioInvestor, the leading source of market information and intelligence for the global crop protection and seeds & traits industries. The inclusion of AgbioInvestor data provides the most accurate view of market information for each AI in the AgbioChem database.

With AgbioInvestor’s market leading crop protection report, AgbioCrop, integrated into AgbioChem, subscribers to both services gain access to not only the technical and market information from AgbioChem, but also to the analytical information available in AgbioCrop, providing a further level of product information, as well as growth forecasts across all AIs. Also integrated into AgbioChem is AgbioNews, the news and reporting service from AgbioInvestor, which provides the most recent and relevant developments across the industry, focused into daily updates for each AI in the database.

AgbioInvestor was established in 2017 to provide news and analysis covering the global crop protection and seeds & traits industries. The partners at AgbioInvestor, Fraser McDougall, Allister Phillips, Derek Oliphant and Garry Mabon, have over 50 years of combined experience from their history in senior analytical and managerial roles in the industry. This has led to AgbioInvestor rapidly becoming the leading source of global crop protection market information and analysis in the industry.

As a dynamic and vibrant company, it is able to offer intuitive and interactive methods of accessing this data and analysis whilst delivering the accurate and reliable information with which it has quickly become synonymous.