Agrochemicals

China’s pesticide enterprises show outstanding financial performance amid high prices 28th February 2018

By Patrick Schreiber, Marketing & PR Executive at Kcomber Inc

Kcomber Inc’s Patrick Schreiber gives an overview of the pesticides industry in China with a focus on company performance

Kcomber Inc’s Patrick Schreiber gives an overview of the pesticides industry in China with a focus on company performance and price development in 2018.

After 60 years of continuous development, China has become the leading producer, consumer and exporter of pesticides in the world. However, parts of China are seeing tension in the supply of pesticides, as production materials such as coal, oil and gas have been in short supply since 2017, and environmental measures are driving some pesticide enterprises to reduce operating rates. This situation has resulted in shortened supply, dramatic price hikes and reduced inventories.

Therefore, pesticide supply during the 2018 spring ploughing season has attracted the attention of industry insiders, many of whom believe that the pesticide market will be in tight supply with resulti ng price rises. As China now supplies 70% of the world’s pesticides, these developments are of broad interest to all players in the worldwide agrochemicals industry.

ng price rises. As China now supplies 70% of the world’s pesticides, these developments are of broad interest to all players in the worldwide agrochemicals industry.

ng price rises. As China now supplies 70% of the world’s pesticides, these developments are of broad interest to all players in the worldwide agrochemicals industry.

ng price rises. As China now supplies 70% of the world’s pesticides, these developments are of broad interest to all players in the worldwide agrochemicals industry.Enterprise performance

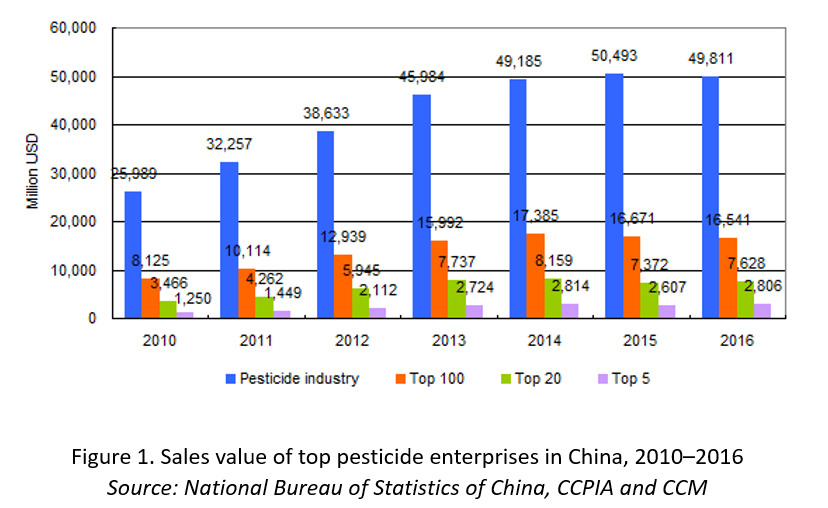

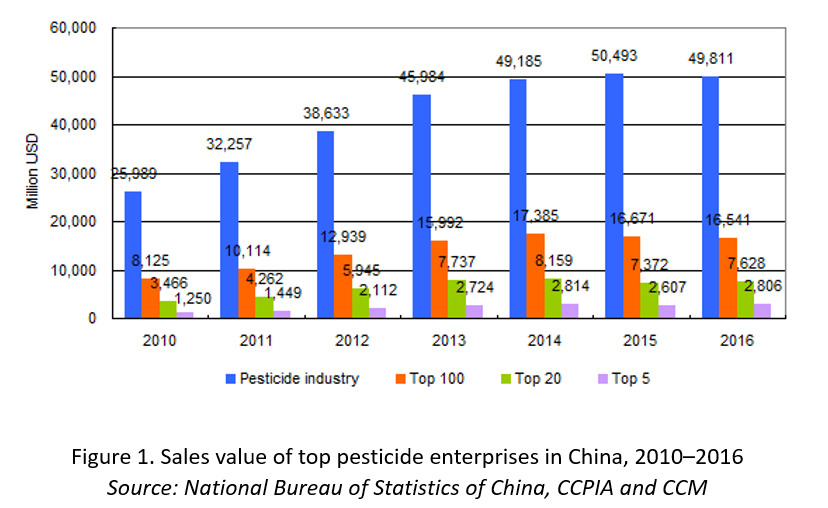

According to market intelligence firm CCM, over 90% of Chinese pesticides enterprises forecast an improved financial performance or a financial turnaround in 2017. In fact, these enterprises have shown an outstanding financial performance (Figure 1), with eight of them reporting that revenue doubled in 2017, compared with 2016.

Hubei Sanonda showed the greatest growth, in terms of financial performance, in 2017. The final figures reflect the company’s acquisition of shares in ADAMA Agricultural Solutions in July 2017, and are expected to show an 18 to 25-fold growth year-on-year, amounting to between $206.20 million and $287.10 million.

In 2018, large-scale enterprises are expected to continue to have a larger market share, and an even further improved financial performance. Increased prices of pesticides could also contribute to significant growth.

Pesticide price

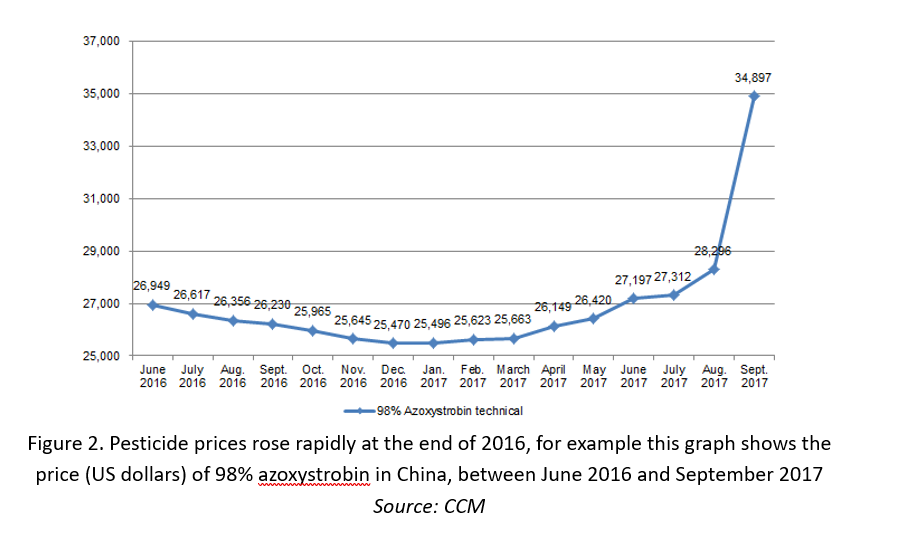

The price of pesticides in China rose rapidly at the end of 2017 (Figure 2), were high at the start of 2018, and are expected to remain so for a least the first half of 2018.

Factors influencing price include:

- Increased raw material prices. During the past year, chemical raw material prices have continually rising in China. As a result, pesticide producers have been facing high production costs.

- Environmental measures. The new Regulations on Pesticide Administration came into force in June 2017. In order to satisfy the new rules, producers are needing to invest more in operational and environmental protection.

- Reduced supply. Many enterprises have suspended production due to environmental inspections. Many industry insiders said that product marketing is becoming harder, and the continuously rising raw material prices will undoubtedly accelerate a reshuffle of the industry.

Looking at the different pesticide segments, herbicide prices are particularly high. Directly affected by the explosion at the Lianyungang Juxin Biotechnology site, m-dichlorobenzene supply was short, leading to rising prices of triazole fungicide, and supply shortages of difenoconazole, propiconazole and tebuconazole. Prochloraz and hymexazol are also out of stock due to short supply of intermediates. The average operating rate of the fungicide market remains low and prices stand at high levels; the same is true for the insecticide market.

Important events in China’s pesticide industry 2018

In 2018, the domestic pesticide industry will continue to be impacted by policies and the market situation of 2017. According to CCM, in 2018, there are five main points that domestic pesticide industry should pay attention to.

First of all, spot checks on the quality of agricultural products will continue being carried out across 2018. Special inspections will be conducted among pesticide producers and retailers. In addition, the authorities will continue with the Production Safety Inspection Campaign in order to avoid industrial accidents.

Companies need to strengthen the quality of pesticides. This includes advancing pesticide traceability systems, continuing to follow policies for designated retail of pesticides restricted for use, and enhancing pesticide risk evaluations, including reassessment of pesticides that have been in use for more than 15 years.

According to officials, about a thousand trace standards of pesticides are to be formulated or revised. Meanwhile, companies might revoke outdated standards that cannot comply with the green development strategy; formulate or revise national or industrial standards regarding pesticide residue, technical specification, rating of products, as well as utilization of waste. In addition, according to the Ministry of Agriculture of the People’s Republic of China, new Regulations on the Prevention and Control of Crop Pests & Diseases are underway.

What’s more, the planting structure of major crops is to be adjusted in China in 2018. According to the Ministry of Agriculture, the planting area of rice is to be reduced. This aims to achieve the goal that over 0.67 million hectares will be reduced in 2018. The planting areas of corn and wheat will also be reduced (especially in areas that have placed too much demand on groundwater, or where common crop diseases originate). More emphasis will be placed on developing featured crops such as traditional Chinese medicinal materials, edible fungi, tea, fruits and food grains other than wheat and rice. Last but not least, China intends to promote the potato as a staple food. By 2020, potato consumption is expected to increase to over 30%.

Finally, China’s Zero Growth of Pesticide Usage Campaign will continue in 2018. This leads to a reduction in pesticide usage with green prevention and control methods. The government is building demonstration bases for the combination of honeybee pollination and green pest and disease prevention and control.

Author:

Patrick Schreiber, Marketing & PR Executive at Kcomber Inc, 17th floor, Huihua Commercial & Trade Building, No. 80 Xianlie Zhong Road Guangzhou 510070, P.R. China

T: +86-20-6293 8903; E: patrick.schreiber@kcomber.com