Materials Science

Driving the growth of adhesives and sealants 6th January 2020

By Vikash Kumar and Annirban Bhattacharya from MarketsandMarkets

In the automotive industry, adhesives and sealants are fast replacing mechanical fasteners, while in the construction industry the

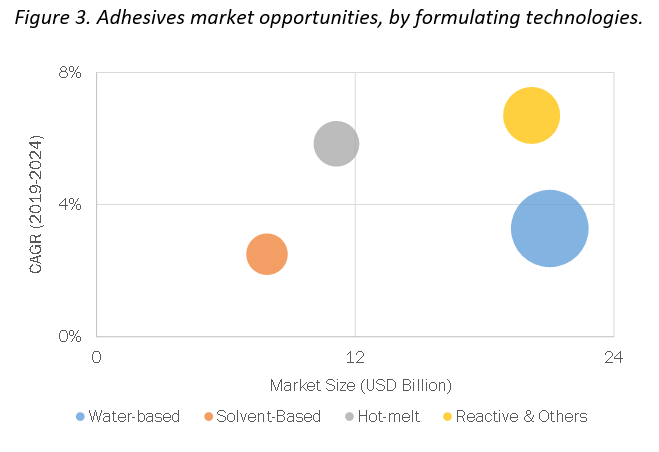

The major challenges for global adhesives manufacturers include economic uncertainty, rising prices of raw materials, the volatile US dollar, slow economic growth, a decline in automotive production, shortage of raw materials, and reduction in consumer expenditure. In addition, stringent environmental regulations in Europe and North America are restraining market growth. On the other hand, increasing demand for green adhesives offers opportunities to manufacturers as environmental regulations compel a shift in focus to producing more eco-friendly adhesives (e.g. water-based adhesives) (Figure 3; bubble size indicates predicted market size in kilotons by 2024).

Reference

1. Markets and Markets. Adhesives & Sealants Market by Adhesive Formulating Technology, September 2019 (https://www.marketsandmarkets.com/Market-Reports/adhesive-sealants-market-421.html).