Materials Science

Emerging impact of batch analytics 15th December 2017

By Artur Beyer, Industry Principal Chemicals, TrendMiner

Many global majors are investing in a strong specialty chemicals portfolio. This article examines the reasons behind this developm

Many global majors are investing in a strong specialty chemicals portfolio. This article examines the reasons behind this development and the impact that batch analytics can have on a company’s market position.

Significant investments by big chemical companies in high-value specialty polymers, amongst others, indicate that the importance of specialty chemicals, and therefore of batch production, is on the rise. While many organizations are still struggling to realize the value that data analytics could bring to their market position, forward-thinking companies have moved ahead of the curve to digitalize their production.

These pioneers have used trends like self-service analytics to create a digitally enabled workforce in order to strengthen their market position and create the most profitable factories of tomorrow. The reasons for this change are unrelated to hype – they are firmly based in financials, such as the return on invested capital (ROIC) performance which represents their operating profitability.

The rise of specialty chemicals

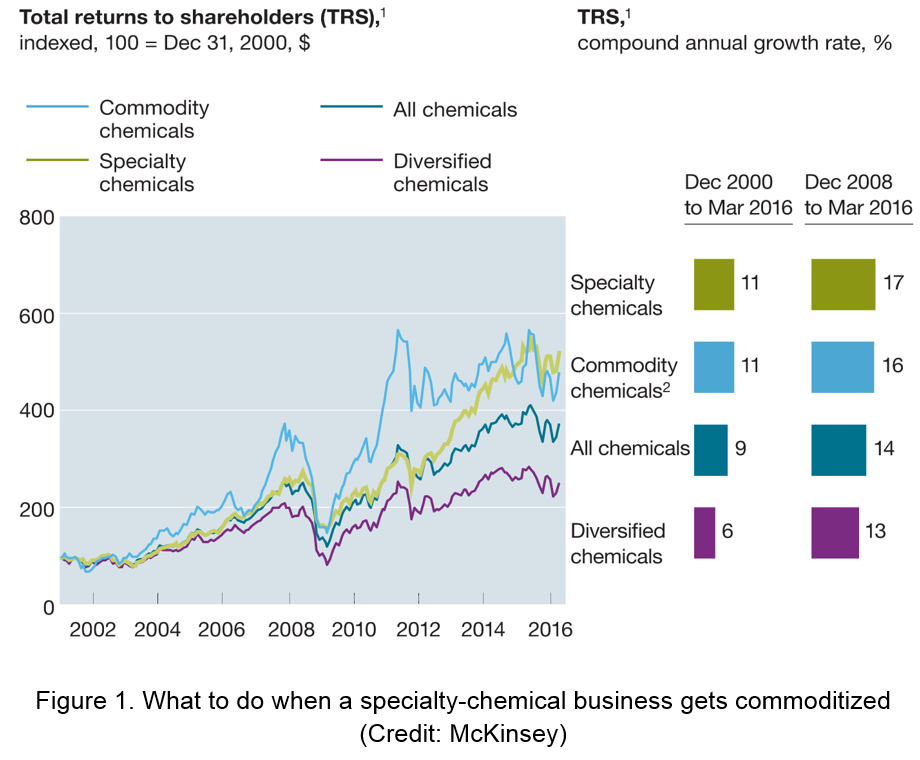

In order to start exploring the reasons behind the increasing importance of strong specialty chemical portfolios, one can take a look at the evolution of the Total Return to Shareholders (TRS) over the past 15 years. For a long time, there has been little difference in the compound annual growth rate (CAGR) when comparing specialty, commodity and diversified chemicals.

However, in the past 4 years, the CAGR in specialty chemicals has rapidly accelerated (Figure 1).1 Since 2016, they have reached the same TRS level as commodity chemicals. With this shift, a strong specialty chemicals portfolio has become increasingly important for overall company value.

Operational profitability in specialty chemicals

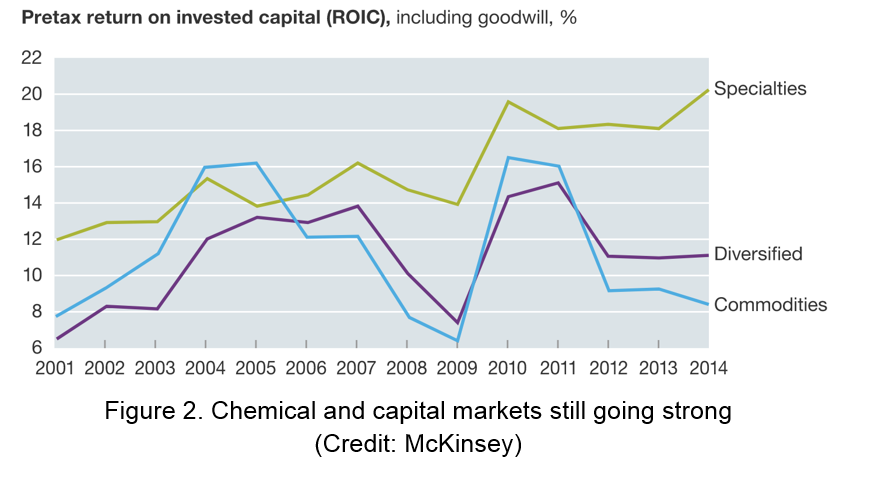

A major study of the chemical market by McKinsey2 showed that operating profitability (ROIC) has a significant influence on a company’s value and market position. Based on this, a connection between the recent rise in influence of a strong specialty chemical portfolio on the value of a company and a strong ROIC performance of this segment seems likely.

Digging deeper, the recent ROIC performance of specialty chemicals has indeed strongly increased, outperforming the other two segments (Figure 2).3 This increase happened around the same time as the surge of TRS of the specialty chemical segment began. This indicates that the increased attractiveness of this segment is connected to stronger operating profitability.

In an ever-changing market, there is a clear incentive to improve operating profitability in order to further strengthen the market position. In general, there are some similar financial aspects within both commodity chemical- and specialty chemical companies’ control, such as cost position, working capital, M&A and operational excellence. Driven by unique product innovation, as well as favourable end market choices, specialty chemical companies do have a bigger influence over market prices when compared to companies from the commodity sector, where the market price is heavily influenced by external factors.

This holds great potential for specialty chemical companies: driving down operational costs and increasing operational flexibility combined with high market- and price control can lead to improvement in ROIC performance. Not only that, it can also help to sustain ROIC performance when this is endangered by commoditization.

The commodity frontier

The commodity frontier

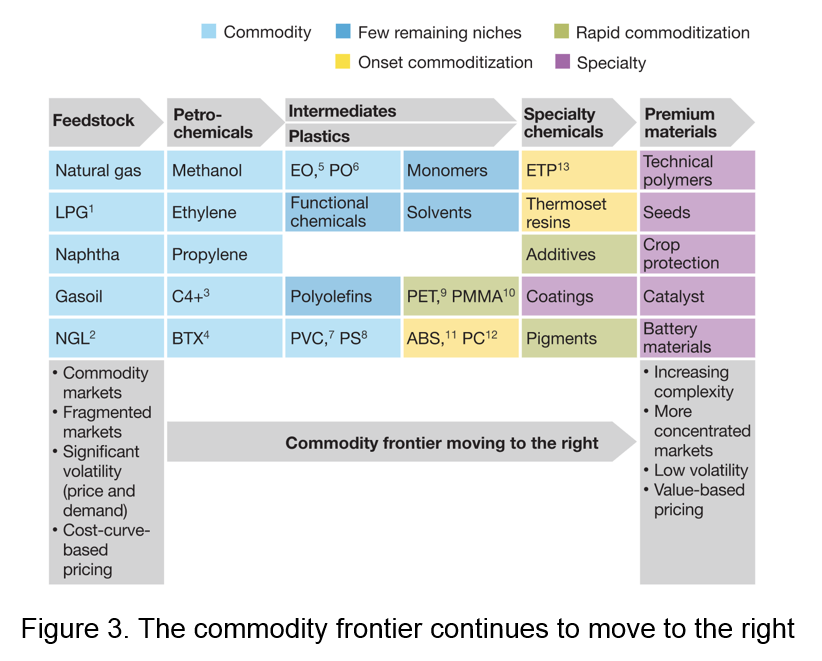

There is always the possibility of losing technological advantage, which can lead to overproduction and losing control over the lower end market prices. Having better control over operating costs as well as an enhanced operational flexibility can ensure adaptability to such new market developments.

Since increased operating efficiency has such a big impact on ROIC performance of a chemical company in any segment, new opportunities for improvement need to be pursued (Figure 3).4

In the 80s and 90s, a major push for Advanced Process Control (APC) took place as the main part of a sustainable solution for increased operating efficiency. Over time, critical shortcomings have been detected when encountering a highly variable and uncertain environment. Examples of this include many capacity and/or product changes. This has inhibited the spread of APC solutions across the whole industry.

Industry 4.0: building the digital workforce of tomorrow

In the context of Industry 4.0, new emerging data analytics solutions can have a significant impact on improvements in operating efficiency. Regardless of the industry segment, the potential is estimated to be in the range of 3-5% improvement in return on sales.

In general there are two possible solutions evolving beyond the focus of APC:

● Utilizing generic data science tooling in combination with the scarcely available data scientist to solve operating problems

● An emerging domain called self-service analytics, which opens up possibilities to empower the process expert to use advanced analytics themselves to directly solve the bulk of day-to-day operating issues

The upside of the self-service analytics approach is the sheer number of opportunities across the organization combined with its low cost of implementation when compared to classical APC solutions. The impact of self-service analytics has significant potential: it is estimated that on up to 10,000 small and mid-size manufacturing performance opportunities the gained profits can add up to €500 million. This can be compared with the potential gains of up to €50 million based on general data science solutions.5

classical APC solutions. The impact of self-service analytics has significant potential: it is estimated that on up to 10,000 small and mid-size manufacturing performance opportunities the gained profits can add up to €500 million. This can be compared with the potential gains of up to €50 million based on general data science solutions.5

In general it is evident that both solutions hold great improvement potential and ideally work in harmony together to build a mature digital organization.

Self-service analytics for batch processes

- Preventing waste on high value batches

- Reducing long cycle times in order to meet customers’ demands

- Enabling an increase in flexibility and a more tailored production utilizing smaller batch sizes.

References

1. Glaschke M et al. What to do when a specialty-chemical business gets commoditized, 2017.

2. McKinsey & Company. McKinsey on Chemicals, 2001.

3. Cao B et al. Chemicals and capital markets: Still going strong, 2015.

4. Böringer J, Simons TJ. Commoditization in chemicals: Time for a marketing and sales response, 2016.

5. Feldmann R et al. Buried treasure: Advanced analytics in process industries, 2016.

Author

Artur Beyer, Industry Principal Chemicals, TrendMiner

Email: artur.beyer@trendminer.cm

www.trendminer.com