Nutraceuticals

Megatrends shaping the food chemicals industry 15th December 2017

By Rinkal Dawra, Research Analyst at MarketsandMarkets

Consumer concerns are driving a megatrend for reformulation, innovation and strategic partnership in the food chemicals industry.

Enormous demand for chemical solutions

Growing Food Demand

According to the FAO, the global population is expected to exceed 8 billion by 2025. Food sourcing and security will assume higher priority in future international agendas. Developing economies such as China and India are generating higher incomes, better infrastructure, and high consumer awareness. This is expected to drive the demand for agricultural products and high-protein foods. The FAO estimates a 70% rise in food production over the next three to four decades to fill the gap between demand and supply. With the current approaches, it would be impossible to fill this food demand.

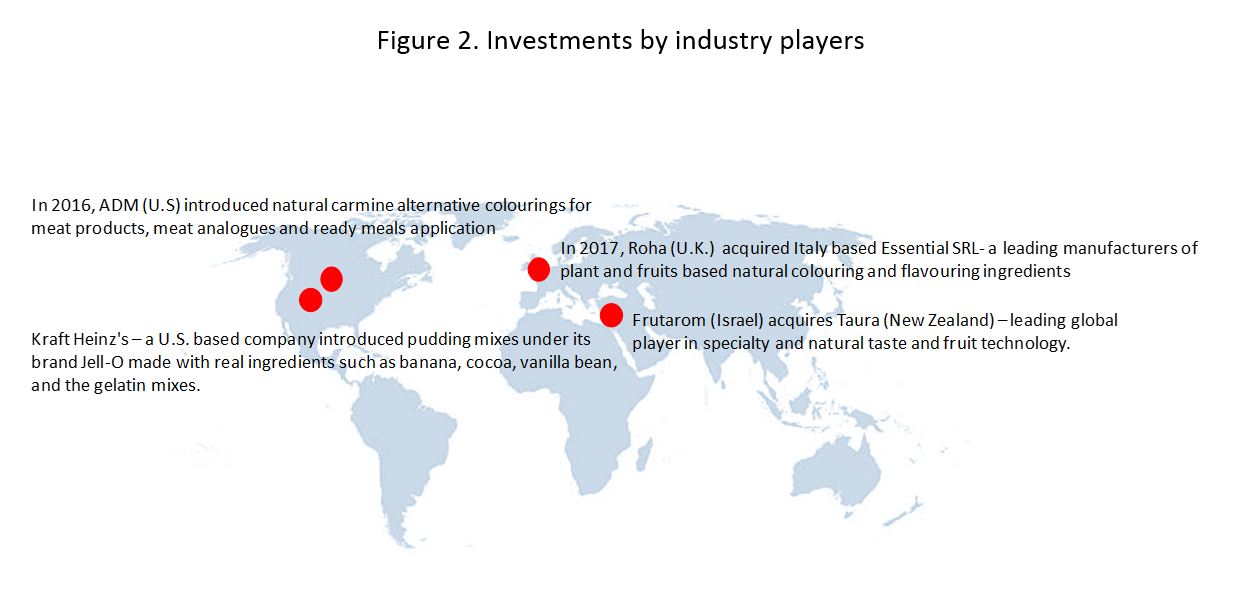

Mega-mergers creating new opportunities

There is an ongoing trend for growing business integration in the global food supply ecosystem. The food and agribusiness value chain comprise a wide range of companies including agricultural machinery seeds, chemicals, and packaged food. Currently, there is a growing trend for consolidation. Major seed companies and chemical giants are moving towards mergers and strategic partnerships for greater sustainability.

The recent merger of DuPont and Dow chemicals in 2016 is a highlighting factor of growing chemicals and agricultural sectors hand in hand. The combined capabilities are expected to create several new opportunities. Along with the merger with Dow, DuPont also announced its acquisition of FMC’s health and nutrition business and its divestiture of part of its crop chemical business in 2017. It was the company’s pro-competitive step towards creating three independent companies aligned with one objective.

Another development took place in the same year when, Chinese state-owned China National Chemical Corp was cleared by the US regulators, to proceed with its $42 billion purchase of Swiss chemical and seeds company Syngenta.

These developments are leading to the integration of food ecosystems which would increase opportunities in the food chemicals market.

Growing food processing industry

Food chemicals is a mature market; these materials are widely used in the food supply chain across agriculture, packaging, and as preservatives. The consumption of food chemicals has shown constant growth; consumption rises with growth in population and per-capita income, especially in emerging regions. With growing consumer demand for flavourful, nutritious, colourful and affordable products, the food processing industry is growing rapidly, and this in turn is fuelling demand for food chemicals.

Food additives comprise all the different chemical compounds/substances used for preserving food; adding or maintaining nutritional value; and improving taste, texture, and appearance. The global food additives market was valued at $42 billion in 2016, and is expected grow at a CAGR of 5.6% between 2017 and 2022, to reach $58 billion.

The growth of processed and convenience food is on the rise in the emerging nations of South America, Asia Pacific and the Middle East, and is exhibiting double-digit growth in countries such as China and India. This is expected to create prospects for food chemicals in these regions.

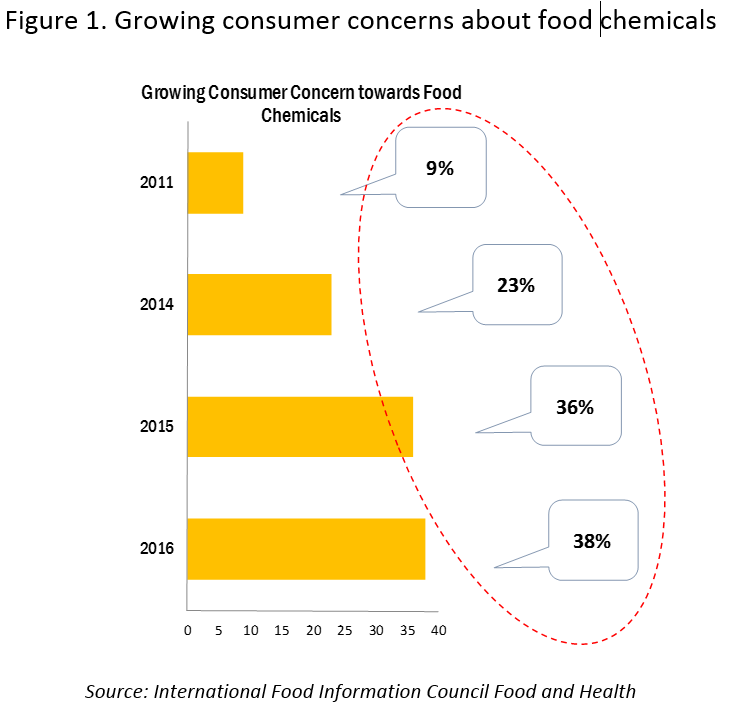

Consumer Concerns about Food Chemicals

- In 2015, Nestle USA became the first major candy manufacturer to announce the removal of artificial colours and flavours like ‘red 40’ and ‘yellow 5’ from its chocolate candy products.

- Azodicarbonamide is an extremely common ingredient used in bread for strengthening dough. fully approved and as safe by the FDA. However, in 2015, restaurant chain Subway stopped using this chemical in its bread in response to consumer concerns.

Rising concerns drive safety testing

E: rinkal.dawra@marketsandmarkets.com; T: +91 9907918779

www.marketsandmarkets.com